how much is mass meal tax

Visitors to Minneapolis Minnesota pay the highest meals tax. A local option meals tax of 075 may be applied.

How To File And Pay Sales Tax In Massachusetts Taxvalet

Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes.

. Sales of meals to Harvard faculty and staff are taxable. A combined 10775 percent rate. We literally do less than one percent of sales in takeout and the profit margin is comparable three percent.

Capital gains in Massachusetts are taxed at one of two rates. The tax is 625 of the sales price of the meal. How much is a typical meals tax.

The cost of a Massachusetts Meals Tax Restaurant Tax is unique for the specific needs of each business. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. Sales tax is calculated by multiplying the purchase.

How Much Does It Cost to Get a Massachusetts Meals Tax Restaurant Tax. First enacted in the. Massachusetts doesnt have local sales tax rates only a statewide tax rate of 625.

Most long-term capital gains as well as interest and dividend income are taxed at. Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Massachusetts Capital Gains Tax. A 625 state meals tax is applied to restaurant and take-out meals. So you would simply charge the state sales tax rate of 625 to buyers in Massachusetts.

Sales of meals to Harvard students are tax-exempt if. The sales tax imposed on a meal is based on the sales price of that meal. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the.

Hotel rooms state tax rate is 57 845 in Boston Cambridge. In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return. Combined with the state sales tax the highest sales tax rate in Massachusetts is 625 in the cities of Boston Worcester Springfield Quincy and Cambridge and 103 other cities.

Combined rates are also high in Chicago Illinois 1075 percent Virginia Beach. 2022 Massachusetts state sales tax. In Massachusetts there is a 625 sales tax on meals.

Sales Tax Calculator. The sales price is the total amount paid by a purchaser to a vendor as consideration for the sale of the. Exact tax amount may vary for different items.

Sales tax is a tax paid to a governing body state or local for the sale of certain goods and services. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where. Total CostPrice including ST.

The base state sales tax rate in Massachusetts is 625. In the state of Massachusetts any service charge by a caterer is not considered to be taxable so long as the caterer prepares food which was owned by the client at a fixed location. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes.

Meals taxes tend to range from anywhere between 05 percent to as high as 55 percent. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1. Cities like Miami Virginia Beach Milwaukee.

Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. This means that the applicable sales tax rate is the same no matter where. The Massachusetts MA state sales tax rate is currently 625.

The meals tax rate is 625. Meals are sold by Harvard. We pay rent for seating space not kitchen space for takeout.

A local option for cities or towns. Massachusetts Salary Tax Calculator for the Tax Year 202223 You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223.

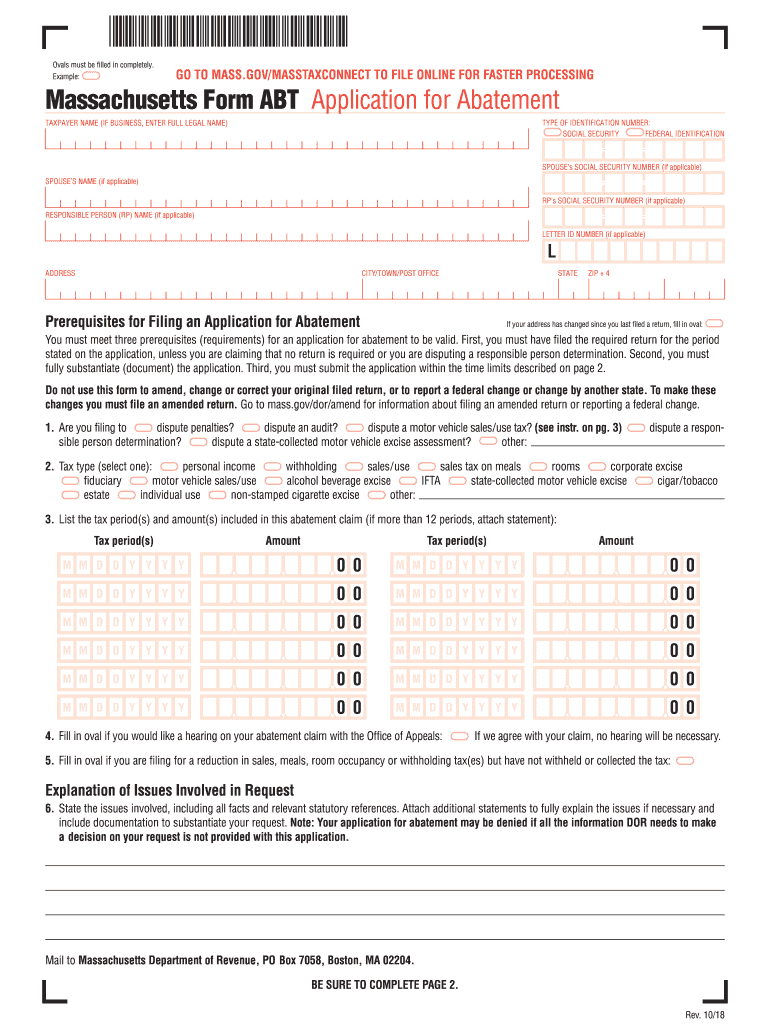

Ma Dor Abt 2018 2022 Fill Out Tax Template Online Us Legal Forms

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

How Do State And Local Sales Taxes Work Tax Policy Center

Massachusetts Aviation Sales Tax Exemption Continues To Fuel Economy Nbaa National Business Aviation Association

Mass May Tell Amazon To Charge Sales Tax The Boston Globe

Mass Officials Extend Tax Relief For Local Businesses Boston Business Journal

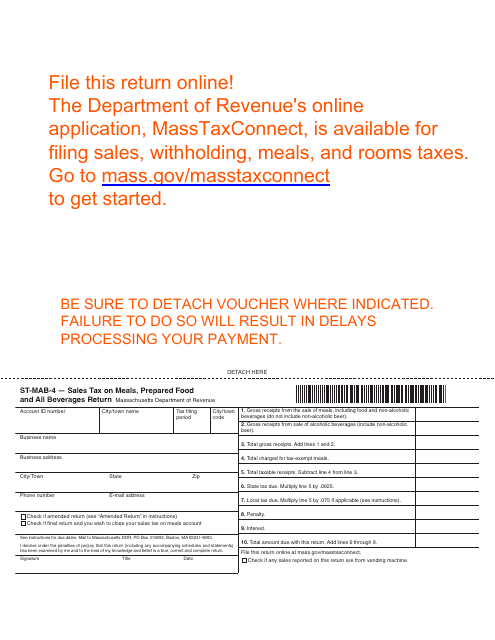

Form St Mab 4 Download Printable Pdf Or Fill Online Sales Tax On Meals Prepared Food And All Beverages Return Massachusetts Templateroller

Mass Will Collect Sales Taxes On Online Purchases Wbur News

Amazon To Begin Collecting Mass Sales Tax Friday The Boston Globe

Form St 5 Sales Tax Exempt Purchaser Certificate Mass Gov

When Is Mass Sales Tax Holiday Legislature Calls For August Weekend Nbc Boston

Mass Tax Refund To Do Little To Help Lower Income Residents It S Expensive To Be Poor Masslive Com

Massachusetts Sales Tax Handbook 2022

Everything You Need To Know About Restaurant Taxes

February Mass Home Sales Hit 17 Year High Agency Checklists

Massachusetts Sales And Use Tax Bonds Ez Surety Bonds

Debate About Future Of Small Biz Funding In Mass Gets Wrapped Up In Sales Tax Fight The Boston Globe